Assessing the links between impact and commercial value

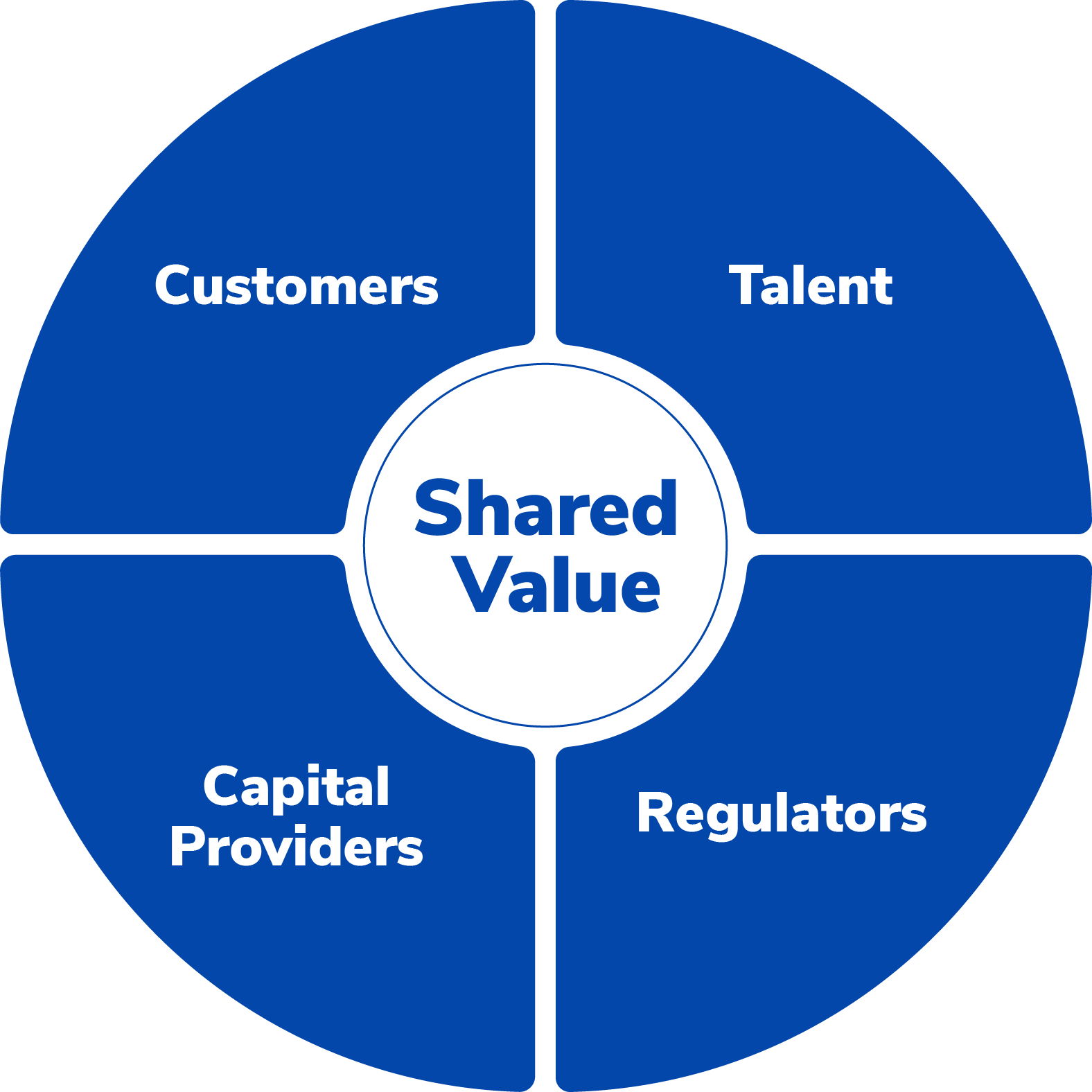

It is becoming increasingly clear that impact and commercial value can interact in a positive way. There's a list of resouces at the bottom of this page that unpack this dynamic, and we summarise our thinking here. It's important to remember that some of these dynamics play out over the long term, and so should be thought of as part of building a winning enterprise over time, rather than considering immediate ROI. We think there are four key stakeholder groups where interesting dynamics are emerging between the pursuit of impact and value:

Customers – There are multiple levels at which mechanisms exist here. A relatively superficial one is the degree to which customers prefer impactful products and brands. At a deeper level there are dynamics around enhanced unit economics eg when reaching underserved populations and unlocking new market segments through innovative revenue streams.

Talent – Talent is critical to building a winning startup, and younger generations of talent are increasingly looking for meaningful careers. Building an impact-driven startup could be one way of winning top-tier talent through offering talent a career that is aligned with their values.

Regulators – Regulators are becoming increasingly interested in the impact of business on society and the environment. Legislation introduced to prevent negative impact from payday lenders, or unethical insurance practices, demonstrate this well. By building an impact-driven business, founders can stay ahead of the regulatory curve and minimise shocks to their business.

Capital providers – If all of the above is true, then capital providers will increasingly want to back impactful businesses. We are already seeing these trends emerge with dramatic increases in ESG and purpose-driven investing. Most recent Atomico data shows early-stage investing in impactful business models has grown 3x in the last few years.

If we accept that impact can be a source of value in building a winning business, the best investors will become increasingly more sophisticated when analysing this.

The simplest way we've found of thinking about this, is to take established ways of thinking about startup dynamics, and layering in an impact lens on top of them. For example, how does the impact mission of the company affect customer acquisition, lifetime value, market size and so on. Some of the resources below get at these questions, although we are still a few steps away from a clear framework on assessing value here.

General:

Eka Venture's investment thesis highlights the 'shared value' behind impact and financial returns

Ascension's data showing impact investments perform better than non-impact investments

Customers:

The 'Impact Moat'

Talent:

Case studies highlighting links between impact and commercial value:

Wagestream (financial wellbeing)

Urban Jungle (affordable insurance)

Ophelos (debt resolution)

Oyster (future of work)

Last updated